10 lessons from investing in Global Iranian startups

Our strategy of investing in global Iranians and in Iranians globally has taken us to wonderful places in the world. We have searched the…

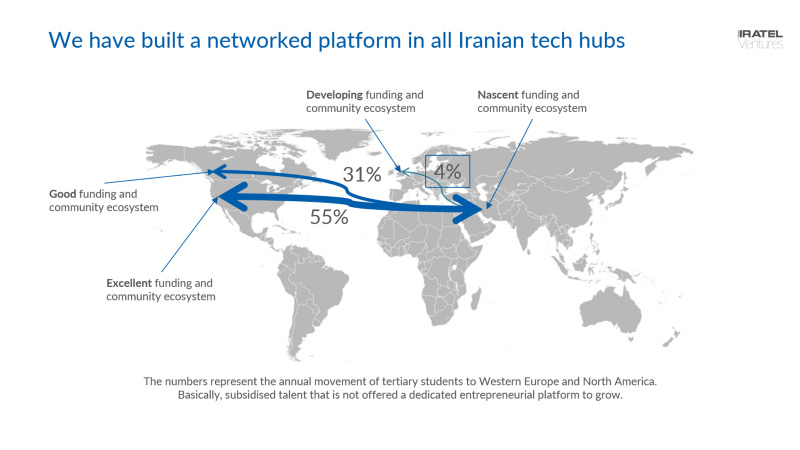

Our strategy of investing in global Iranians and in Iranians globally has taken us to wonderful places in the world. We have searched the major hubs of Iranian tech population (Iran, US, Canada and UK) as well as unlikely places such as Chile, Venezuela and Gibraltar. We have seen more than 2,000 startups by or related to Iranians.

In our quest to find what can turn Iranian talent to global talent we’ve gathered a strong data set about entrepreneurship activity globally and have learnt many lessons along the way.

These are the lessons learnt:

1. ماست مالی & lack of discpline

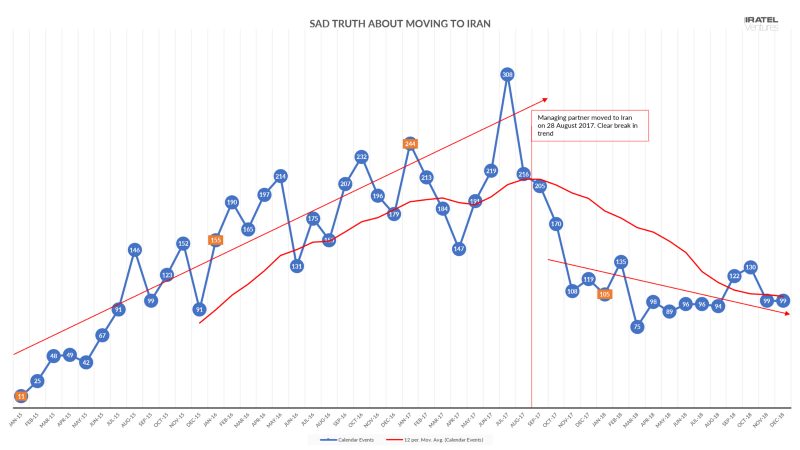

This is simple and really harms business. A sad truth is that the number of meetings we could physically take or attend in the local market was reduced by an order of magnitude due to lack of discipline and also the local traffic. Our office was based in the Arjantin Sq area, which during rush hours takes 60–90 minutes to travel to/from.

Maast Maali also means that people don’t obsess about being on-time, nor doing work that they’re proud of. You see a lot of cutting corners and half-baked results. This, in the long term, lowers respect and morale in any professional environment.

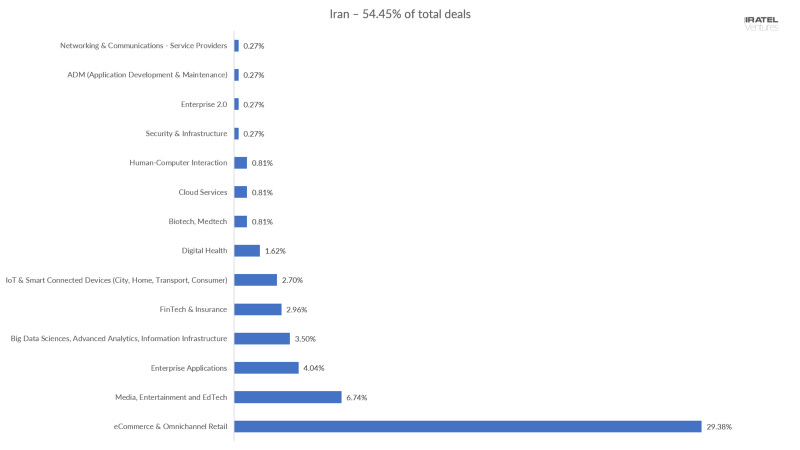

2. eCommerce dominates the local entrepreneurship market

This is not a big surprise as eCommerce is yet to develop fully in the local market, it is a less risky type of investment and most of the “innovation” is being copied from the proven models elsewhere.

3. Series A crunch is a startup killer, globally

Nearly all startups in our portfolio came close to dying due to lack of ability to raise Series A. This is true for startups in the US as well as the ones in Iran. Some had to do multiple bridge rounds which hurt valuation and morale. According to CB Insights, nearly 61% of seed stage startups fail to raise Series A.

4. We are too optimistic about the short-term

The average time between rounds is longer than most runways. Startups usually raise for a 15 or 18 months runway, but the average time it takes for them to raise follow on funding is 20 months. This, combined with the previous point, means that many just lose momentum and face a slow death.

5. Cofounding teams are bad at teamwork

Cofounder relationships are hard. Only 13% of our portfolio companies have more than one Iranian cofounder and are still functioning well. The other ones have either decided to change their relationships or there is one Iranian cofounder working with non-Iranian cofounders.

6. Iranian techies lack an appreciation for business-oriented founders

While evaluating our portfolio companies we give them scores. This might be subjective but gives us a rough heatmap of where we’re doing well and where we need to act. On average, startups score 50% higher in product than in business and funding.

They need to be much more customer facing and customer centric than purely technical. (As Max Mahyar would advise them constantly, make what you can sell, not “sell” what you can make).

7. Local exit is a fantasy

We’ve had 2 exits in our portfolio both of which are in the US. We’ve had an acquisition offer for another one of our startups in Europe. However, we have not seen any local startup achieve an exit and in our discussions with investors, they are still hoping for IPOs for their startups! We don’t think this is realistic.

8. Sanctions make entrepreneurs more resilient

We saw the psychological effects of sanctions appear long before it affected business in a meaningful way. The world is connected and no one can live long on an island without interacting with others. Fortunately, software businesses can still navigate the difficulties, and be compliant, so we should not worry about seed and early stage startups that have real products that can create real value.

True but the downside is the world of ideas and innovation is immense and free interaction (mobility, ability to interact with the rest of the ecosystem) takes away from the learning process.

9. No world-class sector for entrepreneurs and VCs

Initially, we thought we’re going to spend a couple of years scouting the talent and then zoom in in one or two sectors, however, we still haven’t found a thesis that can drive us towards exceptional founders. We’re seeing good deals in all sectors but still prefer enterprise software and digital health.

(machine learning and AI, not capital intensive but software, unless there are constraints on using AWS, etc, a lot of talent that can be applied to these activities)

10. Accelerators churn out low quality startups

On our internal rating system for deal quality, IV Score, accelerators came third to last (out of 14) with a score of 1.7 compared to an average of 5.9 and a max of 12.8.