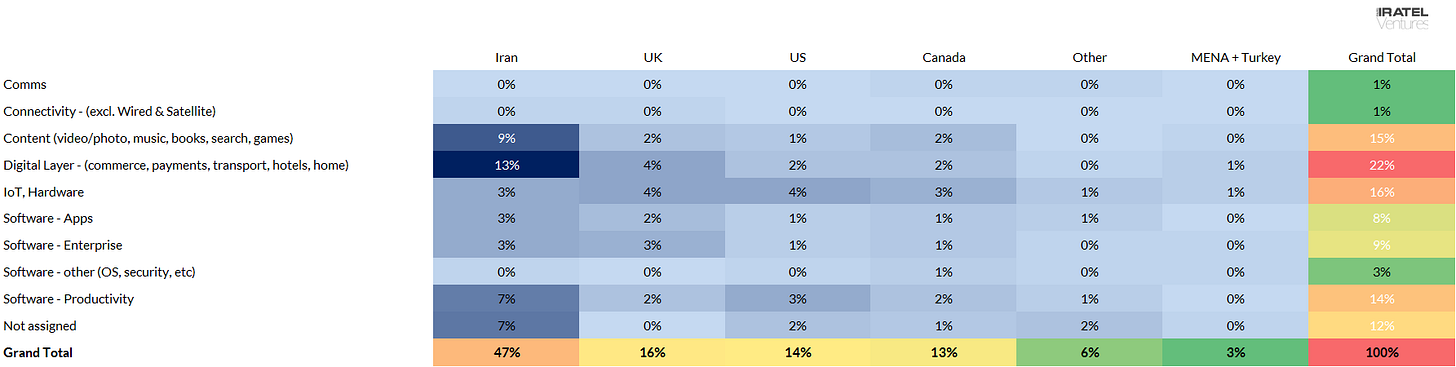

Startup Sectors Heatmap

Tech ecosystem data from Iratel Ventures dealflow

Tech ecosystem data from Iratel Ventures dealflow

Data is being accumulated and communicated at unprecedented rates. According to Cisco, worldwide internet traffic increased by a factor of twelve in just five years between 2006 and 2011, reaching 23.9 exabytes per months. IDC estimates that there were 2.7 zettabytes of digital data in the world in 2012, almost half as much existed in 2011. We believe not being open and transparent, will cost us in the long term and affect our productivity negatively which is why we are big advocates of transparency and openness.

In the previous post, we highlighted the findings from IV Score and presented the data in a survey format. Our data showed that 53% of teams say they have a complete or rather complete team.

Many respondents were positive about their market size with 45% estimating theirs to be larger than $500m.

A large segment (68%) claim that they have a clear, succinct and focused product.

Nearly half say their product is defensible because it is replicated with difficulty as opposed to only 13% who plan to defend their product using patents.

Products are spread across stages: prototype (18%), private beta (24%), public beta (28%) and fully launched (24%). Only 6% say they only have a plan and no product yet.

To see the full list of questions and responses, refer to the previous post.

In this post, we’d like to present another dimension of this data: sector heatmap. This helps us identify trends in the data, spot where we’re seeing good numbers and actively search in sectors where we think there is room for more innovation.

The numbers in each cell represent the percentage of grand total, not each column. For example, Digital Layer in Iran is 13% of the total deal flow and almost a quarter of all deals in Iran.

Let’s dive deeper into the data. As expected, majority of deals (53%) falls in Digital Layer and Content. IoT and Hardware rounds up the top three for us.

On the other hand, excluding communications and connectivity, Software (OS, security, database software, etc) represents the smallest proportion of deals (and in our opinion the biggest potential).

Comms and connectivity are capital intensive sectors and need huge regional and global collaborative environments to be successful, therefore, we’re not actively looking for deals in these sectors.

We’re seeing good numbers in productivity but would still like to see more. We believe there are clever solutions that can be built in this area in an effective and capital efficient way. The areas that we’d like to improve our dealflow further are Software — Enterprise, Software — Other and IoT, Hardware.

We hope this data is useful and can help you think about your competitive landscape more intelligently. We’d love to hear your comments and see what other dimensions of this data could be useful in planning your startup. We take great care in collecting, analysing and presenting our data, however, we encourage you to do your own research and due diligence before any decision making.

This is the seventh in a series of posts about our investment criteria and ecosystem resources which was also posted on LinkedIn. We’d love to hear from teams with crazy (but commercial) startups. Get in touch or attend our breakfast series. Finally, don’t forget to get your IV Score or talk to our FundingBot to prepare for your next VC meeting.

Thanks to Dr. Golnaz Borghei for her contribution.

Iratel Ventures (@iratelventures) | Twitter

The latest Tweets from Iratel Ventures (@iratelventures). We invest in entrepreneurs building global companies. Venture…twitter.com

Iratel Ventures

Iratel Ventures is a VC firm investing in entrepreneurs building global companies at seed and early stage in the Middle…www.linkedin.com