GEX Ventures deeptech thesis - part 1

Part 1 (2015-2024)

Deeptech captures imagination because it blurs the line between science fiction and everyday reality. Think of products like these:

Flying Cars

Joby Aviation's eVTOL Aircraft (pictured above): Joby Aviation is developing an all-electric, vertical take-off and landing (eVTOL) air taxi. This aircraft is designed to carry a pilot and four passengers at speeds of up to 200 miles per hour with zero operating emissions. It has a range of 100 miles and is optimized for rapid, back-to-back flights. Joby plans to launch commercial passenger service in cities around the world by 2025

Robots

Boston Dynamics' Humanoid Robots: Known for their advanced robotics, Boston Dynamics has created robots like Atlas, which can perform complex tasks and navigate challenging environments. These robots have been featured in various media and are often seen as a glimpse into the future of robotics.

Artificial Intelligence

OpenAI's Generative AI Products: OpenAI has developed AI technologies that are revolutionizing various sectors. Their AI models are capable of generating human-like text and have been widely discussed in both tech circles and popular media.

Biotechnology

Moderna's mRNA Vaccines: Moderna, a biotech company, has become a household name due to its development of mRNA vaccines for COVID-19. This technology represents a significant advancement in biotechnology and has been widely covered in the news.

Quantum Computing

IBM's Quantum Computers: IBM is a leader in quantum computing, developing quantum processors that have the potential to solve complex problems far beyond the capabilities of classical computers. Quantum computing is often featured in science fiction and tech discussions.

Autonomous Vehicles

Waymo's Self-Driving Cars: Waymo's advancements in autonomous driving technology have made self-driving cars a reality. These vehicles use AI and machine learning to navigate roads and have been prominently featured in discussions about the future of transportation.

Advanced Materials

Ribes Tech's Photovoltaic Panels: This company has developed ultra-thin and flexible photovoltaic panels that can be used on various surfaces, including roads and buildings. These panels represent significant advancements in material science.

Space Exploration

SpaceX's Starlink Satellites: SpaceX is deploying a constellation of satellites to provide global internet coverage. This ambitious project has been widely covered and represents a significant advancement in space technology.

As amazing as these technologies sound, every investor’s first reaction is the uncertainty surrounding the long road to commercialization.

How I invest in deeptech

From an investment point of view, unlike traditional software investments, deeptech startups often involve longer development timelines, higher capital requirements, and greater risks due to the complexity and novelty of the technologies involved.

Assessing the Risks and Rewards of deeptech Investments

Are deeptech companies too risky, or do they offer an attractive risk-reward balance for venture capital investments? In this post, I'll discuss the commercial lens I use to evaluate deeptech opportunities, focusing on three key aspects: value chains, unit economics, and end-user markets.

Value Chains

When analyzing a deeptech venture, it's crucial to understand the entire value chain involved in bringing the product or service to market. This includes examining the sourcing of components, manufacturing processes, distribution channels, and ultimately, how the offering reaches the end consumer. A thorough value chain analysis can reveal potential bottlenecks, inefficiencies, or areas where the company can create a competitive advantage.

Unit Economics

Unit economics refers to the profitability of each unit sold or customer acquired. For deeptech companies, it's essential to evaluate the costs associated with research and development, production, marketing, and sales, and compare them to the potential revenue generated per unit or customer. Favorable unit economics can indicate a sustainable and scalable business model, while unfavorable unit economics may raise concerns about long-term viability.

End-User Markets

Finally, a deep dive into the target end-user markets is necessary to assess the potential demand for the deeptech offering. This involves understanding the pain points or unmet needs of the target customers, their willingness to pay for the solution, and the competitive landscape. A clear understanding of the end-user markets can help determine the potential for market adoption and the company's ability to capture a significant share of the market.

Example: Smartphones

I think of smartphones as the first contemporary example of a deeptech product that sets new metrics standards on value chains, unit economics, and end-user markets. Smartphones were the first product to bring advanced technologies from tech labs to the remote corners of the world. The value chains are complex global networks for sourcing components and assembling devices, unit economics are attractive with clear profitability of each unit sold or customer acquired, and the end-user markets are driven by unstoppable consumer demand, with significant upgrade cycles built into the business model.

Smartphones brought mobile communication and more importantly mobile internet to billions of people and digitized aspects of our daily lives previously unimaginable.

When I began investing in 2015, I looked beyond the smartphone market itself. I considered the potential ripple effects and derivative opportunities it could create. Specifically, I analyzed three aspects:

Value Chain Derivatives: What new value chains or business models could emerge from the smartphone ecosystem? For example, mobile apps, accessories, or services built around smartphone usage.

Unit Economics Insights: How could the unit economics of smartphones inform the viability of other novel products or services? Aspects like manufacturing costs, pricing strategies, and profit margins could provide valuable insights.

End-User Market Parallels: Are there other end-user markets displaying similar consumer demand patterns as the smartphone market? Understanding such parallels could reveal opportunities in adjacent industries.

I arrived at Internet of Things (IoT) as the next S-Curve of innovation resulting from the success of the smartphone. Here’s the first post I wrote about IoT in October 2015 which ended with this quote:

The final two [smart product] layers, rules/analytics and applications layers, are where we believe majority of the next wave of innovation will come from. It is here where we expect to make the bulk of our investments and are watching trends very closely. It is in these two layers where we can identify patterns in data and in our interactions with connected devices; meaningfully combining all these layers to enhance our lives to deliver the best user experience by producing an autonomous and purposeful product.

Broadening the view

Since then my thinking has evolved to include categories such as Artificial Intelligence, Materials Science, Robotics, Bioinformatics, AR/VR, Quantum Computing, AgTech, Nanotech, Drones, Autonomous Vehicles, Cybersecurity, IoT/Sensors, CleanTech/Energy and SpaceTech.

From this list, I knew that biotech and healthcare investing required a very different skillset and network exposure, so we needed to partner with like-minded investors to build a portfolio there which we did.

We then narrowed the scope down to categories of AI, robotics, AR/VR, cybersecurity, energy, drones and autonomous vehicles leaving out material science, quantum computing, agtech, nanotech and spacetech to be tackled later.

Example: Autonomous Vehicles

Having a prepared mind and a large dose of luck took me to the autonomous vehicle industry next. I studied, wrote about and invested in the mobility-as-a-service value chain with the autonomous vehicle at its core. I specifically found testing and validation to be a major problem to be solved in this space.

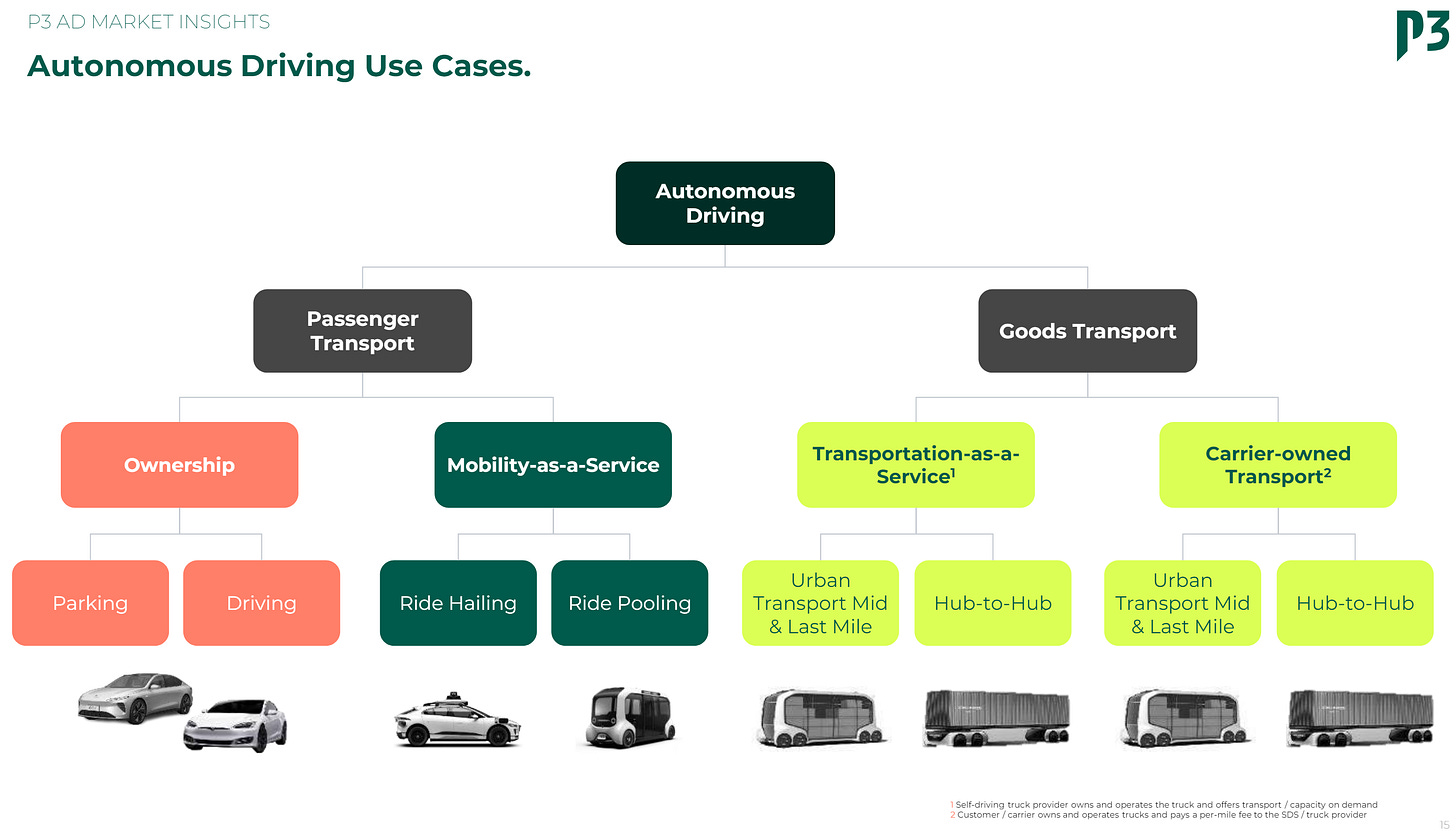

Autonomous vehicles and mobility-as-a-service solutions are enjoying sophisticated value chains in both the traditional transportation industry and the emerging technology supply chains. Value chains are emerging, involving technology providers, fleet operators, mobility service platforms, and infrastructure enablers. Unit economics will be a critical factor and a major commercial uncertainty, with autonomous mobility services aiming to offer lower costs per mile than private vehicle ownership by optimizing utilization and eliminating driver costs. The end-user markets are the main drivers of the investment into this market as consumer and business demand are believed to be similar or greater to smartphones. The picture below is a good summary of where the demand from end-user markets will come from.

Next: Consumerization of Autonomy

I’m exploring the next potential S-curve that could present attractive investment opportunities. Specifically, I’m considering the convergence of the best elements from the smartphone (consumer electronics) and autonomous vehicle (consumer robotics) value chains. By combining these technologies, new groundbreaking products could emerge.

My approach is to analyze the opportunity from an end-user market perspective, aiming to identify one or two companies that could potentially reach over $100 billion in valuation. These companies may be shaping the future we once considered science fiction, making it our everyday reality within the next decade.

Stay tuned for part two on Consumerization of Autonomy.

[Update: read part 2 here.]

This is an educational post about GEX Ventures investments. It is for informational purposes only and may not be relied on as legal, tax, securities or investment advice and does not constitute an offer to buy or sell interest in any products offered by us or others. Email me at mk@gex.vc or leave a comment if you’d like to exchange ideas.