GEX Ventures deeptech thesis - part 2

Part 2 (2024 and beyond)

In the last post, GEX Ventures deeptech thesis - part 1, we saw products that are turning science fiction into everyday reality in fields like Flying Cars, Robots, Artificial Intelligence, Biotechnology, Quantum Computing, Autonomous Vehicles, Advanced Materials and Space and explored our the background to our deptech thesis around investing in these types of opportunities.

In part 2 of our deeptech thesis, I’ll explore the Consumerization of Autonomy as an investment theme and show how it is the result of the convergence of the best elements from my journey into the world of smartphones and autonomous vehicles.

I’ll continue to use the same commercial assessment framework covered in the earlier post, focusing on value chains, unit economics, and end-user markets.

Consumerization of Autonomy

The "consumerization of autonomy" refers to the trend of making autonomous technologies accessible and appealing to the end user to provide a consumer-like experience. Think of how Slack turned enterprise communication into a consumer-like chat experience for professionals, how Stripe made building digital payment infrastructure a consumer-like experience for developers, or how Zoom revolutionized video conferencing by providing a user-friendly interface and seamless experience.

These trends, enabled by the underlying cloud technologies, significantly increased the adoption of these products in both professional and personal settings. A similar trend is now emerging in physical as well as digital autonomous products.

Road Autonomy as the Enabling Experience

According to McKinsey, road autonomy attracted more than $100 billion in capital over the last decade. This investment led to major breakthroughs in hardware, software, and systems engineering, making small-scale autonomy possible.

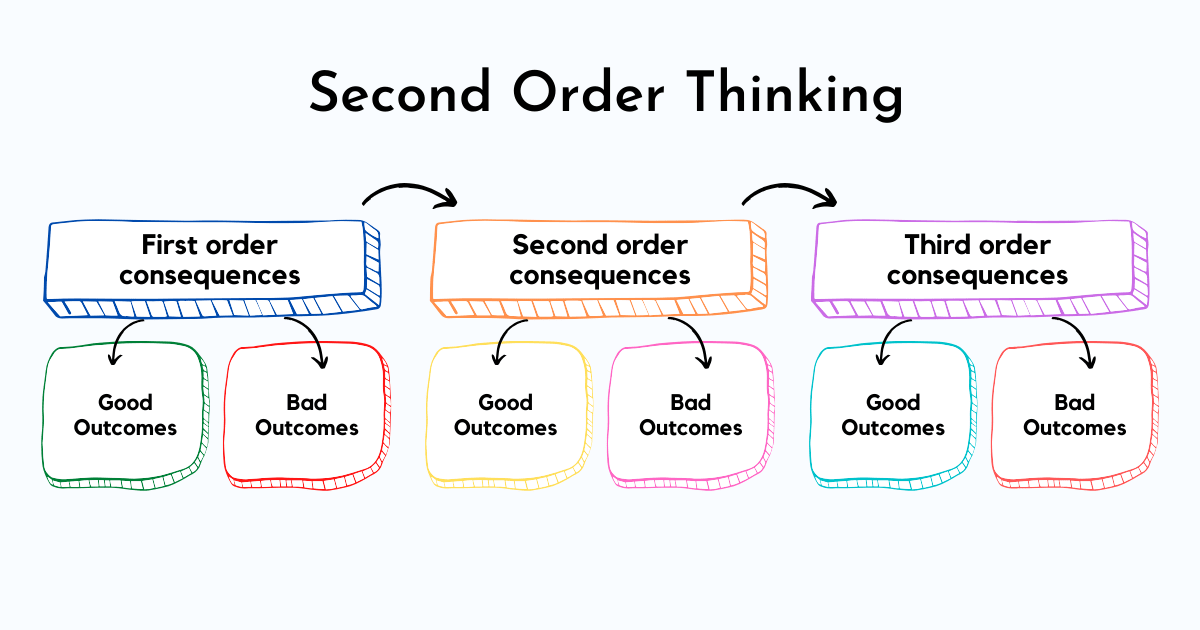

The challenges in bringing road autonomy to market have given rise to second-order effects, as the capital and talent from this space are now being directed towards other autonomy domains. These teams present excellent investment opportunities, armed with the know-how and lessons learned from the autonomous vehicle industry. They are well-positioned to build valuable and capital-efficient startups that are particularly attractive to venture capital and deeptech investors.

Much like how the mass adoption of affordable automobiles in the early 20th century transformed seemingly unrelated industries, such as hotels and vacations, the great minds that worked on technologies and expertise in autonomous vehicles are now poised to revolutionize various sectors. The value chains for these new autonomous solutions will evolve rapidly, integrating elements from the smartphone, autonomous vehicle, and other relevant industries to create ecosystems where software, hardware, and services are seamlessly interlinked.

Value Chains

The value chains for consumer-like autonomy experiences are evolving rapidly, integrating elements from the smartphone, autonomous vehicle, and healthcare industries. This convergence creates a new ecosystem where software, hardware, and services are interlinked more seamlessly than ever before.

Software and AI: The backbone of autonomous technologies is sophisticated software, including AI and machine learning algorithms. These technologies enable devices to perform complex tasks with little or no human intervention.

Hardware: Advances in sensors, cameras, and processors are critical. These components, initially developed for smartphones and later on perfected for self-driving cars, are now being adapted for autonomous systems, enhancing their capabilities and reducing costs.

Services: The rise of cloud computing and data analytics services supports the deployment and continuous improvement of autonomous technologies. These services enable real-time data processing and decision-making, which are crucial for the functionality of autonomous systems.

Unit Economics

Understanding the unit economics of autonomous products is essential for evaluating their investment potential. Unit economics involves analyzing the profitability of a product on a per-unit basis, focusing on metrics like Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC).

Customer Lifetime Value (LTV): This metric estimates the total revenue a business can expect from a single customer over the duration of their relationship. For autonomous products, LTV can be substantial due to ongoing service subscriptions, updates, and maintenance as well as the decreasing cost of delivering that service due to system improvements.

Customer Acquisition Cost (CAC): This measures the cost of acquiring a new customer. In the context of consumer-like autonomy experiences, CAC can be high initially due to the need for educating the market and building trust in new technologies. However, as adoption increases and economies of scale are realized, CAC is expected to decrease.

Profitability: The balance between LTV and CAC determines the profitability of autonomous products. Companies working to ensure that the LTV significantly exceeds the CAC can achieve sustainable growth. This balance is crucial for venture-type startups as it influences their ability to scale and compete in the market.

End-User Markets

The end-user markets for consumer-like autonomy experiences are diverse, ranging from individual consumers to businesses and public sector applications.

Individual Consumers: Products like autonomous chat agents, autonomous vehicles, smart devices and robots are becoming more prevalent. These technologies offer convenience, safety, and efficiency in constrained domains, making them attractive to a broad base. The adoption of these technologies is driven by their ability to enhance individual productivity in daily life and provide new experiences.

Businesses: Autonomous systems are transforming both knowledge work and manual work. Service industries are finding ways to deliver their offerings through software with a human-like experience. Industries such as logistics, manufacturing, healthcare, and retail could use autonomous drones, robots, and virtual assistants for delivery, warehouse management, telemedicine, and inspection services, improving operational efficiency and reducing costs.

Public Sector: Different levels of governments are investing in autonomous products for public transportation, infrastructure management, defense and emergency services. These applications can improve public safety, reduce traffic congestion, and enhance the overall quality of life in urban areas.

Conclusion

No matter how impressive the underlying technology, we still need to understand the commercial implications that make an opportunity suitable for venture investment. We look for proven evidence of:

Enhancing individual productivity in daily life while providing new experiences.

Improving operational efficiency and reducing costs for businesses.

Solving challenges in public safety and urban life.

We actively seek out visionary entrepreneurs and investors who have the technical expertise and industry knowledge to build groundbreaking solutions. Our focus is on identifying startups that not only push the boundaries of what is possible but also have a clear path to commercialization and a compelling value proposition for their target markets.

This is an educational post about GEX Ventures investments. It is for informational purposes only and may not be relied on as legal, tax, securities or investment advice and does not constitute an offer to buy or sell interest in any products offered by us or others. Email me at mk@gex.vc or leave a comment if you’d like to exchange ideas.