Raising a VC fund

A VC fund to empower global Iranian entrepreneurs

A VC fund to empower global Iranian entrepreneurs

There are currently 340 seed funds in the market trying to raise funds from small family offices, high networth individuals (HNWIs) and companies. There is a need for niche focused managers who are building long-term platforms that serve as real experts in extremely nuanced communities, industries and sectors. Funds that have solutions to this need will be able to attract capital.

Why are we unique and what’s our focus?

We believe global entrepreneurs need a global VC. We have created a unique financial solution to help those entrepreneurs who want to go global, get a fair shot at doing so. Our first fund is focused on the global Iranian entrepreneurs who understand borders, but are not limited by them. Our timing couldn’t be more perfect. Right now is the time that we need to think beyond borders and empower entrepreneurs to do so. We are well positioned to understand and provide advice on the obstacles in their way. These range from leadership and administrative assistance to providing deep operational guidance. These obstacles could be social, cultural, institutional and economical. We have gone beyond just investment capital and created an innovation centre called iLab which specialises in creating specific solutions in these four categories.

A question that repeatedly comes up at Iratel Ventures Breakfast Series, is about “attracting foreign capital”. Our answer has consistently been that from what we have learned, foreign investors are already in Iran, however, they are mainly interested in the consumer market.

VC is an outlier driven asset category, and the best managers will do amazingly well for their investors and entrepreneurs regardless of competition.

If you really want to build a globally successful business and attract the best VCs, you should build global technologies and attract those who are investing in you rather than a route to a consumer market. VC is an outlier driven asset class and if you’re not building the biggest and the boldest version of what can solve global problems, you are limiting your success and the return to your investors.

This venture mindest combined with our core values of empowerment, transparency, collaboration and maker mindset gives us an abundant source of motivation and energy to pursue excellence on a global scale, empower global entrepreneurs and produce the best returns possible for our investors in the process.

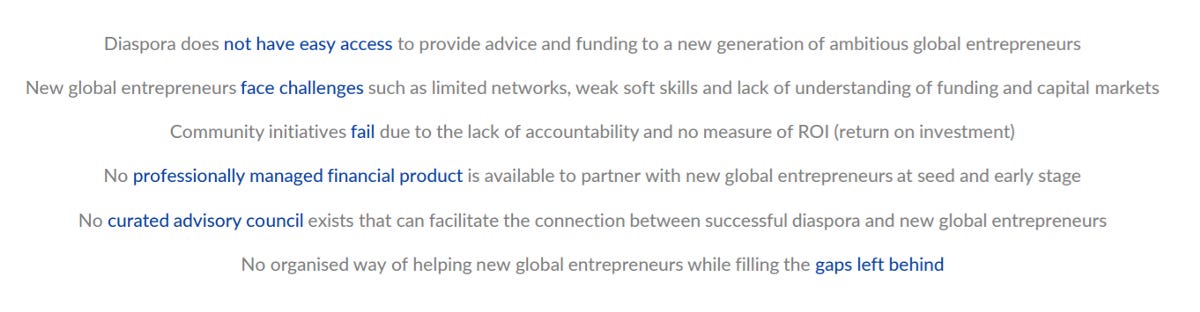

We are currently the only Global Iranian VC firm in the world who is in the market for exponential technology and not just consumer potential. We believe this is the only VC investment strategy with the potential to solve these problems:

Iratel Ventures is dedicated to providing funding to a new generation of ambitious global entrepreneurs.

With early access to entrepreneurs, Iratel Ventures provides practical advice and useful connections to new global entrepreneurs.

Iratel Ventures targets the best in the community and helps them build large enterprises and reach successful exits with measurable results.

A fully regulated VC fund based in Europe that invests in Western Europe and North America.

A committed technology advisory council made up of experienced executives and investors.

Our immediate network builds value systems and mechanisms to give back to our community through IV Founders’ Pledge.

This is the twelfth in a series of posts about our investment criteria and ecosystem resources which was also posted on LinkedIn. We’d love to hear from teams with crazy (but commercial) startups. Get in touch or attend our breakfast series. Finally, don’t forget to get your IV Score or talk to our FundingBot to prepare for your next VC meeting.

Iratel Ventures (@iratelventures) | Twitter

The latest Tweets from Iratel Ventures (@iratelventures). We invest in entrepreneurs building global companies. Venture…twitter.com

Iratel Ventures

Iratel Ventures is a VC firm investing in global entrepreneurs, those who understand borders but are not limited by…www.linkedin.com

Thanks to samir kaji and Max Mahyar for their contributions.