Meeting recap

Iratel Ventures Breakfast Series #2

Iratel Ventures Breakfast Series #2

The people and the vibe of the meeting were very positive. I met great new people there.

I think it's a good system to cycle through different subjects and pick the interesting ones. I also liked the diverse mix of people at the event.

I would like to meet founders and entrepreneurs at a similar level of startup and see a better agenda.

We hosted an outstanding group of investors and entrepreneurs at the second Iratel Ventures Breakfast Series last Wednesday (24 February / 5 Esfand) in Tehran. For this event we experimented with having event pages on Evand (Farsi) and Eventbox (English) to open up the invite list to the wider community. We also wanted to gather the topics and votes beforehand using DotVoter. We came to the conclusion that the simpler versions of invites and paper based voting work better, especially as these events are meant to be friendly and highly engaging within the small attendee group.

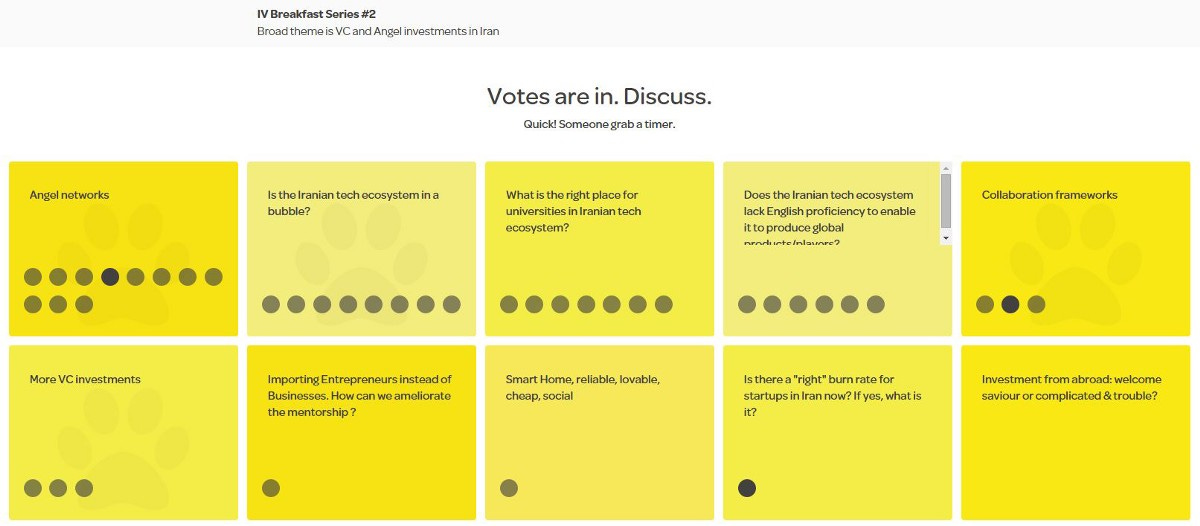

These are the topics and 41 votes suggested before the event:

The three topics which were upvoted at the event were:

VC and Angel investment in Iran

Valuation methodologies

Collaboration frameworks

VC and Angel investment in Iran was opened by how VCs work and the role of venture capital. Added value VC was also discussed as a lot of the entrepreneurs wanted to see more help from investors especially on legal, recruitment and growth subjects. It was discussed that VC, Micro-VC ($100m or less in capital) and Angel investor need to be defined properly and founders need to understand what to expect from each group. A few people wanted to come to a conclusion about this topic but we reminded them that we are here to discuss these topics openly and learn from each other so conclusions are not necessary.

Discussion on Valuation Methodologies started by debating whether Iranian startups are bringing the needed innovation to the market that will raise the standards. There are a lot of technical as well as market risks as was suggested at the previous meeting. The discussion then moved to the fact that there is no accepted valuation methodology and more education on this topic is needed. An entrepreneur who had successfully raised funds for his startup stated that this is really unique to each investor and some may use a market-comparable valuation method or some may not even use any (someone told him his startup was worth “zero”!). It was also noted that accelerators can have a positive contribution in providing a benchmark for valuations as YC has done in Silicon Valley.

Collaboration frameworks between startups and investors and within each group was the final topic. The general feeling was that there are good events in Iran (Hamfekr, Startup Grind, Startup Weekend) right now that are leading to good levels of engagement. if we were to make comparison to other business communities, the startup community in Iran has a lot to be proud of! These events are inspiring a lot of founders to think about new ways of starting their careers as was evidenced by one of the entrepreneurs saying that his main goal for attending was to find a co-founder.

We’d like to thank all the attendees for coming to our breakfast event and contributing to building a better startup ecosystem in Iran. If you wish to attend our next breakfast event, please sign up or follow us on LinkedIn.