Reflecting on 8 years of investing outside Silicon Valley

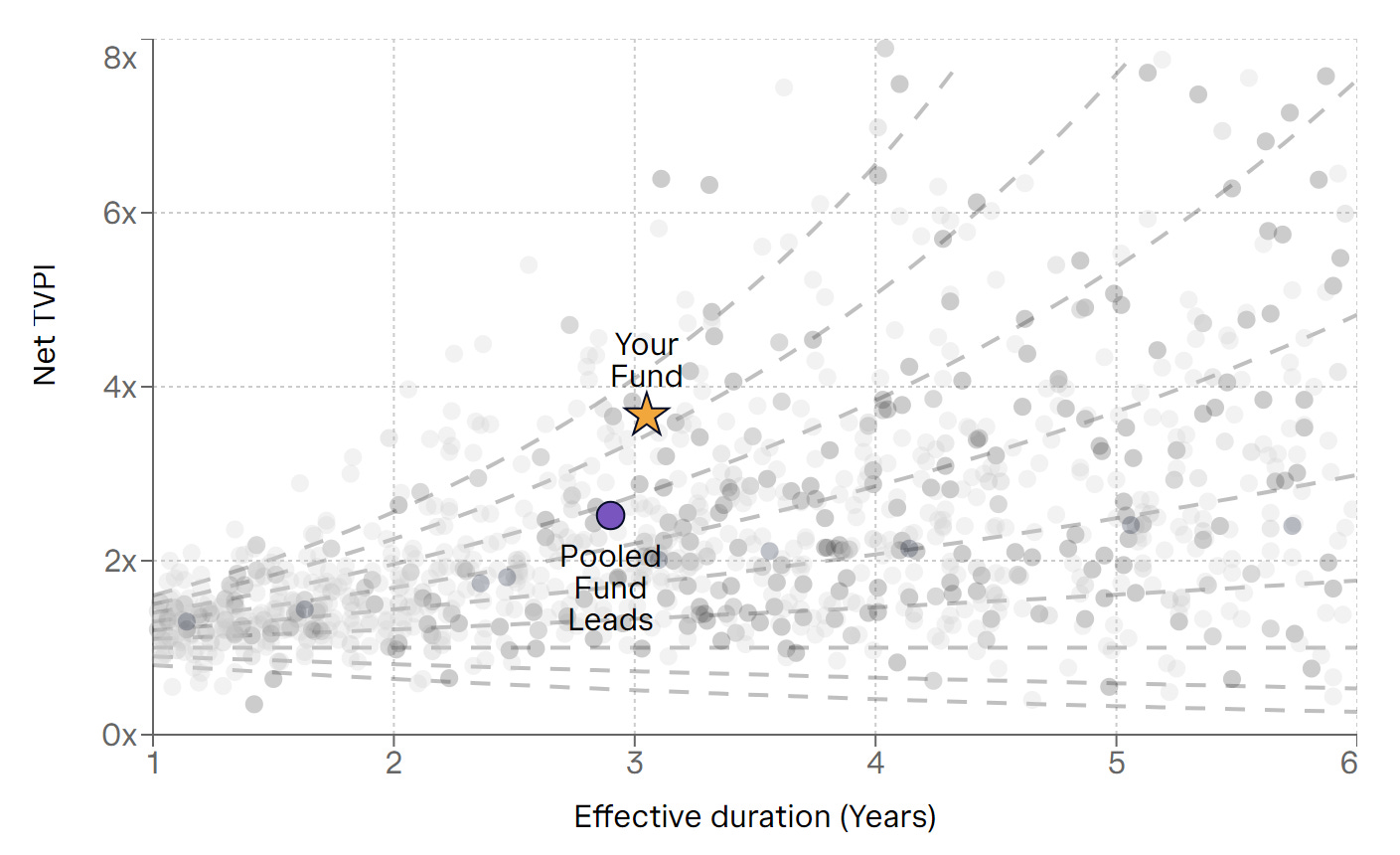

The strategy’s performance ranks in the 88th percentile

At GEX, we’ve been investing in global entrepreneurs since 2015. Our belief in the future of this strategy and the underlying community led us to rebrand from Iratel Ventures to GEX, short for Global Entrepreneur Experience. We deeply respect the special journey global entrepreneurs go through and strive to capture the essence of the resulting experience to inform our decision making for new investments. This is what VCs typically call pattern matching.

Our investing journey started with exploring the benefits of building formal and informal ties with Silicon Valley. Locally, this strategy led to establishing a series of local events, a few angel investments and setting up an innovation lab. In Silicon Valley, it led to a dozen startup investments and a couple of fund investments.

Venture is a long-term asset class and it takes 6–10 years for investment results to be reliable. We’re just starting to see the results of our work. The performance of our direct investments ranks in the 88th percentile according to AngelList VC fund performance calculator. This demonstrates the strength of entrepreneurs on a global scale.

Our informal activities — local events, angel investments and innovation lab — did not lead to any meaningful financial return but we met many amazing investors, founders and ecosystem partners and are happy to have been the ambassador for global thinking and execution within the community. We believed that domestic exits would not be realistic given normal (and already long) venture timelines and the ecosystem’s maturity. Only one startup IPO (rideshare startup) has taken place since the internet economy took shape in the country around 15 years ago. Many of the diaspora who had returned with hopes of building global startups have left or are now building in Silicon Valley directly. We are left with the talent strategy as the only viable investment option.

What is the future of investing in global entrepreneurs?

How can entrepreneurs in the diaspora increase their chances of success? And what benefits can the exchange between them and those building startups within the country bring, if any?

Email me at mk@gex.vc or leave a comment if you’d like to exchange ideas.

This is a post about ecosystem resources which was also posted on our blog to benefit global entrepreneurs. If you’re thinking about becoming global or have global aspirations, get in touch.