From global to generational

The American Silicon Valley

I previously wrote about the move away from globalization. Here we'll explore our evolving view of entrepreneurship from a global perspective to a generational one, reflecting on key events that have shaped this transition and its implications for the future of business and innovation.

From global to generational

The world has witnessed a significant shift away from the globalization paradigm that dominated economic thinking in the past few decades. Three major events have catalyzed this change:

Brexit: The UK's decision to leave the European Union

COVID-19 Pandemic: Global shutdowns and supply chain disruptions

Russia-Ukraine War: Geopolitical tensions and economic sanctions

These events have fundamentally altered our perception of free trade and the unrestricted movement of people and ideas, which were once considered unassailable pillars of economic growth.

In May 2017, two years into startup investing, I wrote about GEX’s belief in the global nature of entrepreneurship:

From the outset, we believed that entrepreneurship can only be global. We believe an entrepreneur should have a purpose much larger than themselves. This purpose should be to benefit every human being on the planet, directly or indirectly. We are certain every great business that has ever created value does this in its own unique way.

While we still believe in the above statement, our approach has evolved. GEX, originally standing for "global entrepreneur experience," now represents "generational entrepreneur experience." This shift reflects a change from a geographic focus to one of stewardship and ambition, emphasizing entrepreneurial success and the resulting experience across generations.

Replicating Silicon Valley

After China cracked down on its consumer internet startups back in H2 2020, I wrote a piece about the type of startups we should be funding and how a very different lens on entrepreneurship versus that formed in Silicon Valley changes outcomes. In that piece, I wondered what should be considered “real tech” and urged the reader to check whether the $288b that had been invested by VCs in H1 2020 was going to create lasting value.

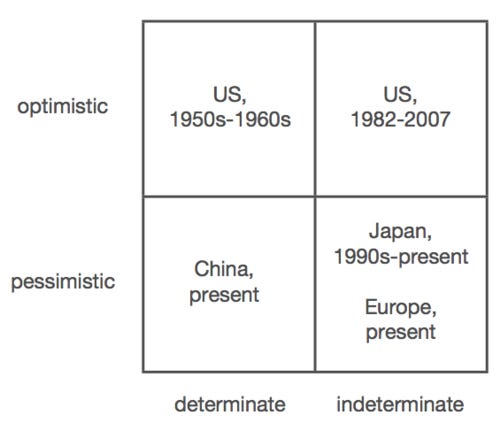

Contrast that period of excess and different type of entrepreneurial outcome to what a16z coined American Dynamism later in 2022. In that piece they concluded that “American dynamism is the belief that the values upon which the country was founded are real and worth defending.” Many people have taken American dynamism at face value which could be seen as defense-tech but in my opinion it is about building companies aligned with what makes Silicon Valley (and the US) the center of generational entrepreneurial success. Behaviorally, it means “optimism and a belief in growth and opportunity”. It could also be seen as what Peter Thiel dubbed Determinate Optimistic vs. Indeterminate Pessimistic Futures, i.e. The American Dream vs. blindly replicated startup ecosystems.

Generational Entrepreneur Experience

By reframing GEX as the "generational entrepreneur experience" we aim to:

Promote fundamentally positive and optimistic values for future generations

Move away from an absolutist view of global entrepreneurship and create a network of like-minded innovators, regardless of their physical location

Attract self-selecting entrepreneurs who resonate with the "American Dream"

I’ve personally been working towards this alignment for a decade, a journey I deeply cherish. I feel lucky that this journey is allowing me to contribute to the success of generational entrepreneurship and better understand the resulting experiences.

This is an educational post about GEX family office. It is for informational purposes only and may not be relied on as legal, tax, securities or investment advice and does not constitute an offer to buy or sell interest in any products offered by us or others. Email me at mk@gex.vc or leave a comment if you’d like to exchange ideas.