What Are You Motivated By? (2024 Update)

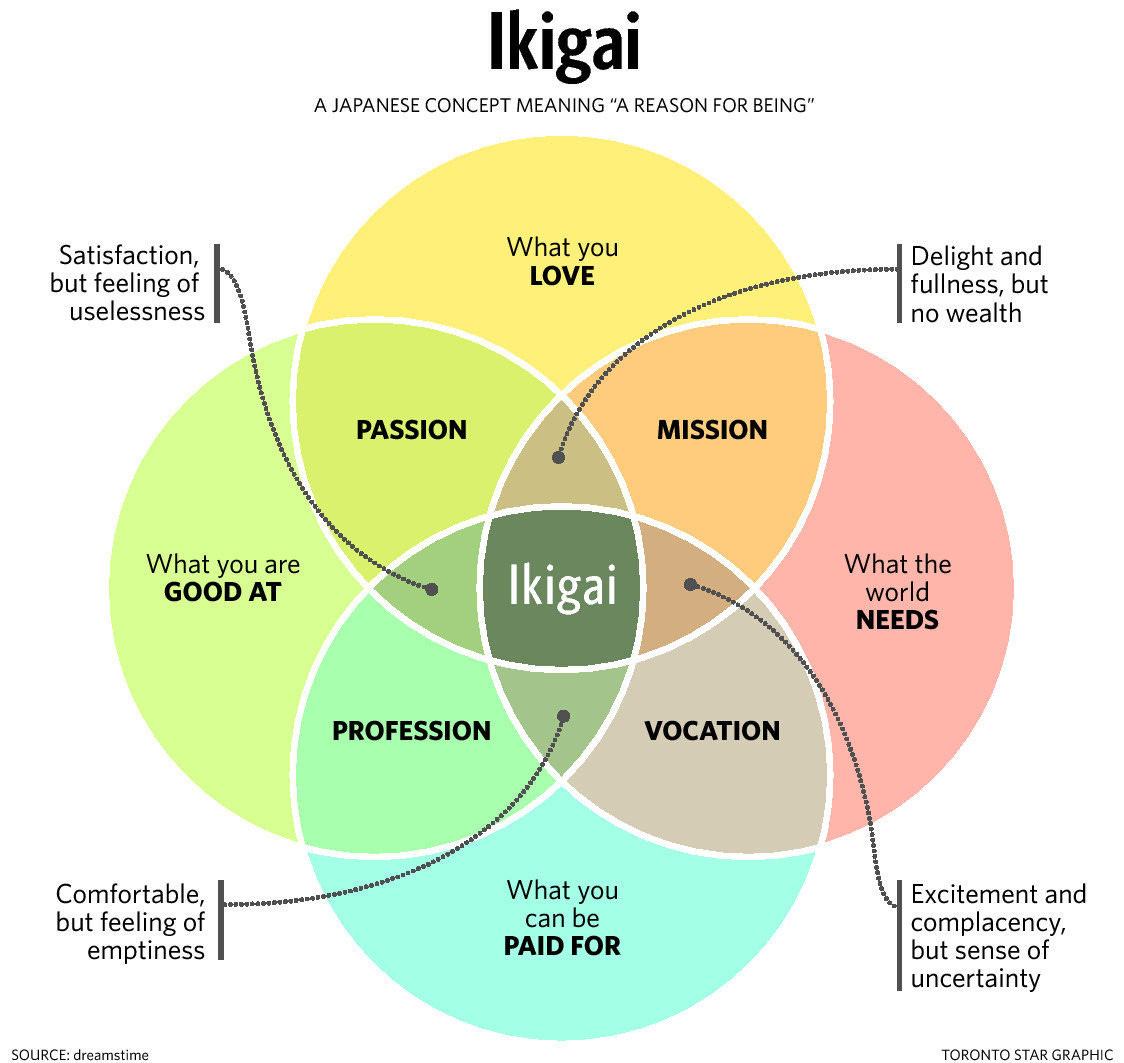

When I first wrote about the concepts of motivation and ikigai in 2018, I couldn't have predicted how they would shape my entrepreneurial and investing journey. Finding purpose by applying this framework to my work has not only provided immense satisfaction but also guided the evolution of our strategy at GEX. Today, I want to share how these insights have culminated in our fund of funds approach.

Revisiting the Four States of Motivation

In my original exploration, I identified four states of motivation: fear, reward, duty, and love. These states, when considered through the lens of ikigai, offer a powerful framework for understanding what drives us and how we can achieve true fulfillment. In my 2022 update, I reflected on how these motivation states presented themselves at that point in my journey.

Fear: The Catalyst for Change

Fear can be a powerful motivator, especially in entrepreneurship where the fear of failure often propels founders to take their first leap. However, to create something truly meaningful, it is essential to move beyond fear and embrace more sustainable motivators.

Reward: The Double-Edged Sword

The pursuit of success and material rewards aligns with the ikigai aspect of "what you can be paid for". Yet, true fulfillment arises from balancing financial success with personal satisfaction and societal contribution.

Duty: The Bridge to Purpose

Duty resonates strongly with ikigai, embodying the idea of contributing to society and fulfilling responsibilities. It is about finding purpose in serving others and doing what's right, stemming from a place of self-awareness and the unique value one can bring to the world.

Love: The Heart of Ikigai

Love is perhaps the closest motivator to the essence of ikigai. It encompasses passion for what you do and a desire to make a positive impact on others on a sustainable basis.

The Importance of Each Ikigai Element

Passion: What You Love

Without passion, our efforts lack energy and enthusiasm. A strategy devoid of passion feels mechanical and uninspired, failing to ignite the drive needed for innovation and perseverance.

Mission: What the World Needs

If mission is missing, our work lacks direction and purpose. A strategy that doesn't address real-world needs can feel irrelevant and disconnected from broader societal goals.

Profession: What You Are Good At

Without leveraging our strengths (profession), we risk inefficiency and mediocrity. A strategy that doesn't align with core competencies may struggle with execution and fail to achieve desired outcomes.

Vocation: What You Can Be Paid For

If vocation is absent, sustainability becomes an issue. A strategy that isn't financially viable may falter over time due to lack of resources or support.

Overlaying Ikigai on to The Fund of Funds Approach

The fund of funds approach, when viewed through the lens of ikigai, offers a powerful framework for creating meaningful impact in the venture capital ecosystem. By aligning passion (what we love), mission (what the world needs), profession (what we're good at), and vocation (what we can be paid for), we can create a strategy that not only generates strong financial returns but also fulfills a deeper purpose: solving problems for entrepreneurs on a suitably long-term basis amplified through a network of VC networks. This overlay allows us to select funds that resonate with our values, support entrepreneurs who are driven by meaningful missions, leverage our expertise in fund selection and management, and create sustainable value for all stakeholders involved.

Long-Term Vision

Venture capital is not just an investment; it's a commitment to a long-term vision that seamlessly integrates all elements of ikigai. It's a journey where the passion for innovation meets the unwavering mission of founders. This approach fosters professional competence and ensures that financial success becomes the foundation for sustained growth and lasting impact. Imagine a future where your investments are not just financial transactions but profound partnerships that shape the world.

Problem Solving Mindset

At its core, our fund of funds strategy needs to solve problems for entrepreneurs. By investing in multiple venture capital funds, we gain access to a diverse array of insights and expertise that allows us to address the multifaceted challenges faced by startups, from Silicon Valley to the farthest reaches of the globe. Our approach, adaptable and responsive to emerging trends and needs, enables us to support innovative solutions tailored to the unique challenges of each entrepreneurial venture.

Network of Networks

At the heart of our strategy lies a commitment to fostering connections within the most impactful people in the tech community. With a renewed focus on Silicon Valley, we're not just creating a network; we're building a high quality network of VC networks. In a world where entrepreneurs, investors, and visionaries come together in a well structured legal and financial mechanism, sharing knowledge and insights on a broad scale becomes practical and quite powerful. This is our vision, and through our fund of funds approach, we're making it a reality.

Conclusion: Finding Your Ikigai in Entrepreneurship

As we continue our journey at GEX, we remain committed to fostering an alignment for entrepreneurs and investors worldwide. Because when we find our ikigai in business—and ensure all elements are present—we don't just build successful companies; we create meaningful change and lasting impact.

This is an educational post about GEX Ventures investments. It is for informational purposes only and may not be relied on as legal, tax, securities or investment advice and does not constitute an offer to buy or sell interest in any products offered by us or others. Email me at mk@gex.vc or leave a comment if you’d like to exchange ideas.